Rising sun: the drug pricing environment in Japan is on the up

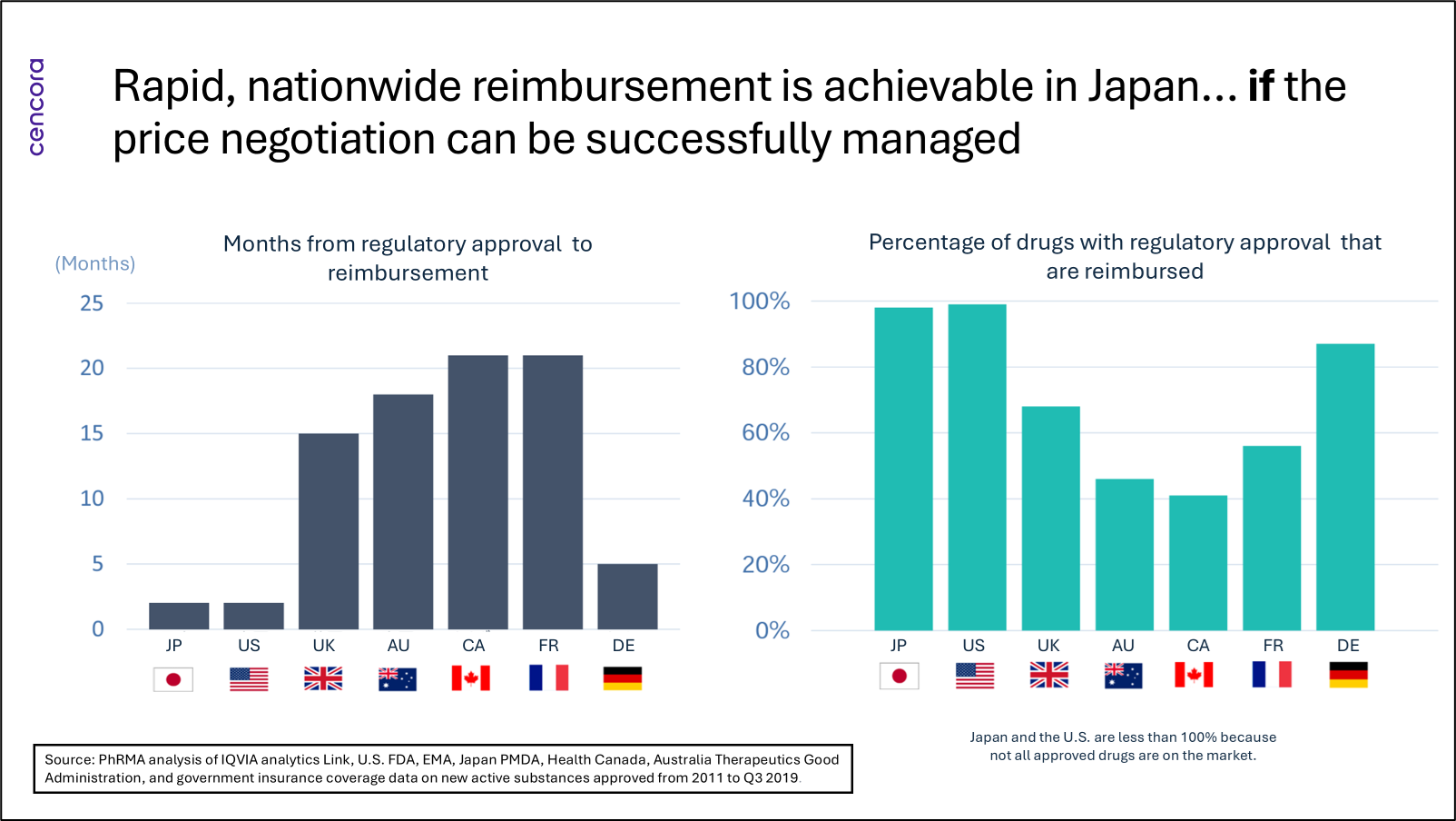

There have long been some major strengths to the Japanese pricing system, principally that reimbursement almost always quickly follows regulatory approval (see figure below). In addition, this reimbursement is nationwide. The only significant hurdle to be cleared between regulatory approval and reimbursement is the price negotiation with the Ministry of Health, Labour and Welfare (MHLW). But there have also been some longstanding weaknesses, mainly that after the launch price has been agreed upon, there are regular price cuts. These—as heard from company general managers in industry association meetings—make business planning more difficult.

The result of these regular price cuts—biennial cuts for all products, but other price cut mechanisms for selected products, too—was that by the end of the first decade of the 2000s, there was a considerable “drug lag” (products reaching Japan much later than the U.S. and Europe) and “drug loss” (not reaching Japan at all). Growing awareness of these twin problems led the government at the time to introduce in 2010 the Price Maintenance Premium (PMP), a mechanism for protecting the more innovative products from the regular price revisions. What followed was a “golden” period of five years or so, in which the pricing system was supportive of innovation and the drug lag and drug loss problems lessened significantly.

Unfortunately, good things don’t always last, and beginning in 2016 with the introduction of annual (not just biennial) repricing for selected products, the pricing system entered a period of deterioration as the Japanese government attempted to squeeze drug spending to manage overall healthcare spending. Revisions to the PMP criteria were made to narrow the range of products benefiting and also to reduce the value of the protection. This decline in the support for innovation led to the somewhat predictable outcome of worsening drug lag and drug loss problems, and commensurate growing concern from numerous stakeholders.

By the early 2020s, the tone of the public debate was shifting, with support for pharmaceutical innovation becoming a cause taken up by several politicians and other stakeholders. At the same time, the industry associations here—for historical reasons, there are three research-based associations representing Japanese, U.S., and European companies: JPMA, PhRMA Japan, and EFPIA Japan, respectively—began to better coordinate their efforts. This combination of a more positive political environment and more effective industry advocacy led to a number of significant positive changes in the annual revision of the pricing system in April 2024.

The changes last spring have made the Japanese market much more positive for the pharmaceutical industry. These changes included:

- Products receiving the PMP will now see their National Health Insurance (NHI) prices fully maintained

- PMP product coverage has been expanded

- A new price premium has been created to incentivise the early introduction of new drugs to Japan

- Requirements have been eased for the granting of price premiums for new drugs

- The spillover repricing rule has been reformed

- The number of products eligible for unprofitability repricing has been increased substantially

So, will there be a virtuous circle—the drug lag and drug loss shrink, followed by further strengthening of the support for innovation, and then further shrinking of those problems? Well, the price cuts announced by the government for April 2025 were disappointing. But there are some positive signs, too. Originator companies themselves may now bring more innovative products to patients here, and even if they do not, others may step in; media reports say that “an increasing number of companies in Japan are showing an eagerness to snatch up ‘drug loss’ assets.” These include not only pharmaceutical companies but also trading companies, contract research organisations (CROs), and wholesalers. Neither the government nor the patients of Japan are likely to care who it is that brings the innovation to the country, so long as it happens.

The upshot is that the drug pricing environment has definitely improved in Japan in the past year. And if things go to plan, it may improve further. In this land at least, the sun is rising.

Sources

-

JPMA/PhRMA/EFPIA. Joint Statement on Proposals for the 2024 Drug Pricing Reform. https://www.phrma-jp.org/wordpress/wp-content/uploads/2023/04/pressrelease230417-eng.pdf

-

Pharma Japan. Gist of FY2024 Drug Pricing Reform. 20 December 2023. https://pj.jiho.jp/article/250145

-

Pharma Japan. Japan Wants to See Positive Trends on Drug Development after Reform: Official. 23 April 2024. https://pj.jiho.jp/article/250840

-

Pharma Japan. Japan’s Drug-Loss Landscape Is Transforming Driven by Private Sector. 21 August 2024. https://pj.jiho.jp/article/251536

-

Pharma Japan. PhRMA Hails 2024 Reform, but Says Full Picture Unchanged as 50% of Patented Meds Still Face Cuts. 4 April 2024. https://pj.jiho.jp/article/250723

-

PhRMA Japan. How Could the 2024 NHI Drug Pricing Reform Reduce Drug Lag and Loss? 3 April 2024. https://www.phrma-jp.org/wordpress/wp-content/uploads/2024/04/2024-04-03press-conference-slides_eng.pdf

-

The MHLW’s Summary of the Changes (Japanese only). www.mhlw.go.jp/content/12404000/001218693.pdf

-

Yamate M. Update of Drug Pricing System in Japan. Ministry of Health, Labour and Welfare. https://www.pmda.go.jp/files/000221888.pdf

This article summarises Cencora’s understanding of the topic based on publicly available information at the time of writing (see listed sources) and the authors’ expertise in this area. Any recommendations provided in the article may not be applicable to all situations and do not constitute legal advice; readers should not rely on the article in making decisions related to the topics discussed.