New opportunities for medicines in Europe? How JCA and Project Orbis may impact the revenue potential of innovative medicines

JCA and Project Orbis: Accelerating Patient Access to Oncology Treatments Across Europe

While extensive research has explored their impact on key industry factors—such as time to market (TTM) and medicine availability—their financial implications, particularly their impact on medicine revenue, have received comparatively less attention. Understanding these commercial effects is crucial, as expedited approvals and broader access can unlock new revenue opportunities while also introducing pricing challenges due to international reference pricing (IRP) practices commonly applied across Europe.

Overview of JCA and Project Orbis

JCA is designed to evaluate the efficacy and safety of new products through a collaborative, harmonised approach across European Union (EU ) member states. Since January 2025, JCA is mandatory for all oncology and advanced therapy medicinal products (ATMPs). European Medicines Agency (EMA) orphan-designated products will be included by 2028, followed by all EMA-registered products by 2030. This initiative directly impacts all EU27 member states, Norway, and Iceland.

Project Orbis

Project Orbis facilitates the simultaneous submission and review of oncology products among international regulatory partners. Led by the United States Food and Drug Administration (FDA), its primary goal is to accelerate patient access to innovative cancer treatments that offer clinical advantages over existing therapies. Participating European regulatory authorities include the United Kingdom (UK) Medicines and Healthcare products Regulatory Agency (MHRA) and Switzerland (Swissmedic).

Quantifying the Revenue Impact

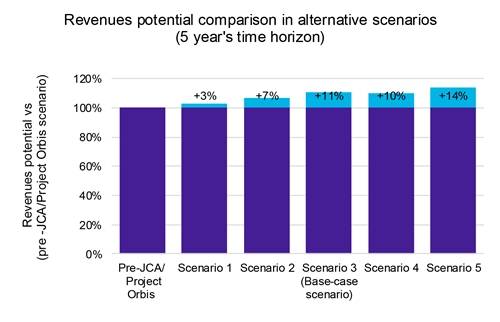

Our approach compared revenue projections under a pre-JCA and Project Orbis scenario—representing traditional regulatory and reimbursement pathways—with 5 alternative launch scenarios. Each scenario incorporated different assumptions regarding how JCA and Project Orbis influence TTM in each country and revenue generation.

Pre-JCA and Project Orbis Scenario

Revenue potential before the introduction of JCA and Project Orbis was estimated based on 48 oncology products approved in Europe between 2019 and 2022 that did not participate in Project Orbis. TTM was defined as the number of days between marketing authorisation and patient availability in each country. Revenue projections over a 5-year period considered the list prices, market size, and IRP rules:

- TTM was based on the EFPIA WAIT report

- List prices for each country were determined based on the median annual treatment cost of the oncology products. Due to the complexities of pricing dynamics and the impact of non-transparent discounts, this analysis relies on list prices rather than net prices to ensure consistency in evaluation.

- European market size estimates, considering the population and per capita oncology expenditure.

- IRP applications at launch and post-launch, following data from the Navlin IRP matrix.

JCA and Project Orbis Scenario

To evaluate the impact of varying acceleration rates, we conducted a sensitivity analysis, assessing revenue implications for TTM acceleration ranging from 10% to 40%.

Under Project Orbis, we estimate that Switzerland could experience TTM accelerations of up to 7 months—an assumption based on the submission gap and review times for oncology products under Project Orbis vs non-Project Orbis pathways in Switzerland. However, we do not anticipate any changes for the UK since it is unclear whether the UK regulatory timeline is truly expedited with Project Orbis. (see Table 1).

Table 1. Summary of TTM scenario

Scenario |

TTM |

|

Pre-JCA and Project Orbis |

Median of the TTM of the 48 oncology products launched in Europe between 2019 and 2022 |

|

Scenario 1 |

UK: No change in TTM CH: 7 months accelerated TTM BE, NE, DK, ES: 10% accelerated TTM + 100 days Other countries: 10% accelerated TTM |

|

Scenario 2 |

UK: No change in TTM CH: 7 months accelerated TTM BE, NE, DK, ES: 20% accelerated TTM + 100 days Other countries: 20% accelerated TTM |

|

Scenario 3 (Base-case scenario) |

UK: No change in TTM CH: 7 months accelerated TTM BE, NE, DK, ES: 25% accelerated TTM scenario + 100 days Other countries: 25% accelerated TTM |

|

Scenario 4 |

UK: No change in TTM CH: 7 months accelerated TTM BE, NE, DK, ES: 30% accelerated TTM + 100 days Other countries: 30% accelerated TTM |

|

Scenario 5 |

UK: No change in TTM CH: 7 months accelerated TTM BE, NE, DK, ES: 40% accelerated TTM + 100 days Other countries: 40% accelerated TTM |

Key: BE: Belgium; CH: Switzerland; DK: Denmark; ES: Spain; JCA: Joint Clinical Assessment; NE: the Netherlands; TTM: time to market; UK: United Kingdom.

Revenue Calculations

Using our internal revenue calculator, we conducted a comprehensive 5-year revenue projection for each scenario and compared the results against the scenario pre-JCA and Project Orbis.

Our analysis indicates that while accelerated product launches lead to modest yet noticeable price erosion (Chart 1), the advantages outweigh the drawbacks. Faster market entry enables the capture of a larger market share within a shorter time frame, ultimately boosting overall profitability (Chart 2).

Furthermore, our revenue sensitivity analysis across these scenarios revealed a potential 14% revenue increase, underscoring the potential financial benefits of an expedited launch strategy.

Key: IRP: international reference pricing; JCA: Joint Clinical Assessment.

Key: JCA: Joint Clinical Assessment.

Conclusions

While faster price erosion remains a consideration, the increased sales volume offsets this risk over a 5-year period. As a result, manufacturers adopting expedited launch strategies under JCA and Project Orbis stand to gain financial advantages while ensuring broader access to life-saving therapies.

Limitations of our analyses

The analysis has several important limitations:

- Revenue calculation: Revenues are estimated using list prices rather than net prices, as net prices for pharmaceuticals are heavily influenced by confidential agreements and undisclosed discounts. To ensure consistency, potential revenues are assessed based on publicly available list prices.

- Baseline TTM: The estimated TTM for the UK and Switzerland prior to JCA and Project Orbis may differ slightly from this analysis’s assumptions. This variation arises because nine of the 48 products used to assess country-specific TTM were evaluated through Project Orbis.

- IRP considerations: Both formal and informal IRP rules have been taken into account. However, informal IRP rules are challenging to evaluate due to inconsistent implementation. Assumptions were made to estimate the extent to which these informal pricing policies are applied.

This article summarises Cencora’s understanding of the topic based on publicly available information at the time of writing (see listed sources) and the authors’ expertise in this area. Any recommendations provided in the article may not be applicable to all situations and do not constitute legal advice; readers should not rely on the article in making decisions related to the topics discussed.

Connect with our team

Sources

- European Federation of Pharmaceutical Products (EFPI). Patients W.A.I.T. Indicator 2023 Survey. June 2024. https://efpia.eu/media/vtapbere/efpia-patient-wait-indicator-2024.pdf

- European Union. Joint Clinical Assessment for Medicinal Products. January 2025. https://health.ec.europa.eu/document/download/ced91156-ffe1-472d-85eb-aa6a91dd707e_en?filename=hta_htar_factsheet-jca_en.pdf

- Government of the United Kingdom. Guidance on Project Orbis. Last updated 10 January 2025. https://www.gov.uk/guidance/guidance-on-project-orbis

- European Medicines Agency. National competent authorities (human). https://www.ema.europa.eu/en/partners-networks/eu-partners/eu-member-states/national-competent-authorities-human

- World Bank. Population total. Last updated 16 December 2024. https://data.worldbank.org/indicator/SP.POP.TOTL

- Cost of treatment. 31 December 2024. Retrieved from Navlin database.

- International reference pricing rules. 31 December 2024. Retrieved from Navlin database.

- Vrdoljak E, Bodoky G, Jassem J, et al. Expenditures on oncology drugs and cancer mortality-to-incidence ratio in Central and Eastern Europe. Oncologist. 2019;24(1):e30-e37. doi:10.1634/theoncologist.2018-0093. https://pmc.ncbi.nlm.nih.gov/articles/PMC6324644/

- Swissmedic. Project Orbis: quicker access to promising cancer treatments. 29 May 2024. https://www.swissmedic.ch/swissmedic/en/home/news/mitteilungen/project-orbis-schnellerer-zugang-krebsbehandlungen.html

- Precision Advisors. The post-Brexit UK access landscape: does Project Orbis significantly accelerate patient access for oncology drugs in the UK versus Europe? 2023. https://www.ispor.org/docs/default-source/intl2023/ispor23kennedyposter-project-orbis-pdf.pdf?sfvrsn=edc15b3_0